Ever since Brexit happened, I had repeatedly stated that I do not believe a hike will materialise this year. Since then, more and more market participants are talking about a December hike – especially after most of the FOMC members have come forward to air their views. While I continue to believe Fed will hold off in September and October, I would like to reassess the possibility of a December hike in this piece.

Last week was all about Jackson Hole, an important event because it was Yellen’s first remarks since Brexit. While her comments were relatively neutral, the greenback managed to push through a delayed rally. As of today, the probability of a Fed hike in Dec stands at around 59%, compared to around 51 – 53% last week. The street’s view, on the other hand, lies somewhere closer to the Fed. Most banks expect a hike in Dec, with Goldman Sachs economists putting it at 80%.

Now that the ‘wild card’ is out, it would be timely to reassess my dollar view. Am I overly pessimistic as the markets have been? My conclusion is that considering the hawkish-tilting FOMC, the risk-reward profile for a bearish dollar view is unfavourable. Along with my previous argument of a risk-off catalyst, oil has recovered some of its losses and Trump hasn’t seem to have recovered since Khizr Khan’s incident. Together, these two risks have subsided and I am now less convicted about my bearish-equities view.

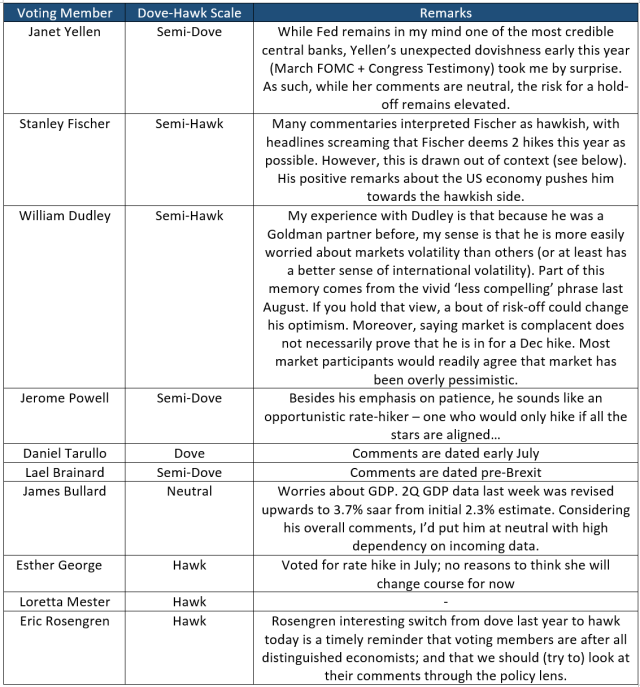

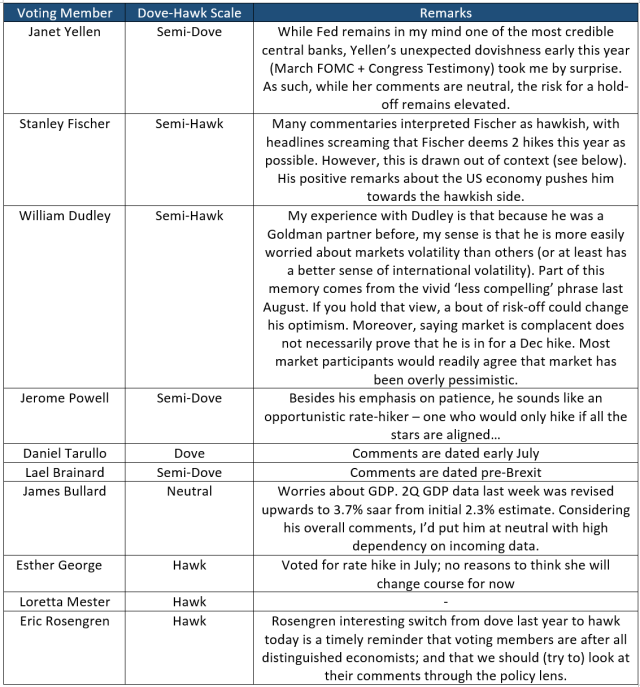

I have compiled comments from each of the voting members at the end of the article. Note that my dove-hawk scale is predicated upon whether governors would vote for a December hike.

Here’s the brief summary:

Here are my observations:

- Overall, there are 5 hawks against 4 doves.

- Among the top 3, it’s 2 semi-hawks against 1 semi-dove.

- For the others, it’s 3 strong hawks against only 1 strong dove.

Having said that, one has to bear in mind that an extremely intelligent discussion first takes place before the vote. This explains why we usually see unanimous voting patterns, as lengthy discussions have turned into consensus. Needless to say, some governors will be more vocal or influential than others. Therefore, the above table only serves as a guide. Non-voting members take part in these discussions as well.

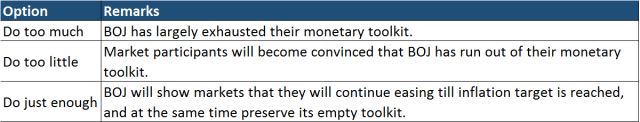

On Fed’s ‘need’ to restock its monetary toolkit…

The rather common view that Fed needs to raise rates to prepare for the next recession has officially been shot down by Fed Chair Yellen herself, who described the argument as “exaggerated”, with other tools such as bond purchases and forward guidance available.

“In addition to taking the federal-funds rate back down to nearly zero, (FOMC) could resume asset purchases and announce its intention to keep the federal-funds rate at this level until conditions had improved markedly.”

Final thoughts…

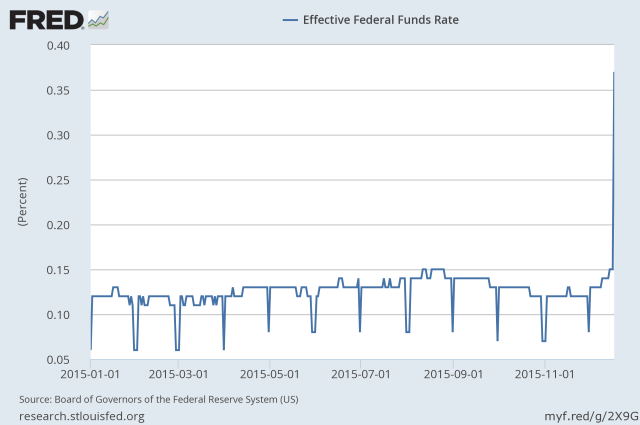

Market participants will again be gluing their eyes on payroll number (cons: 180K) this Friday. I reiterate that labor market is largely a checked box for Fed’s dual mandate. However, given the market’s stubborn pessimism of a no-hike, we may see a price action similar (but in smaller magnitude) to NFP last month, with bonds selling off sharply (treasuries sold off 8-11bps between 2 and 10 year tenors) last month on the back of strong payrolls.

Janet Yellen

Jackson Hole: In light of the continued solid performance of the labor market and our outlook for economic activity and inflation, I believe the case for an increase in the federal funds rate has strengthened in recent months. U.S. economy was nearing the Federal Reserve’s statutory goals of maximum employment and price stability.

Stanley Fischer

Jackson Hole: I think what (Yellen) said today was consistent with answering yes to both your questions, but these are not things we know until we see the data. Core PCE inflation, at 1.6%, is within hailing distance of 2 percent–and the core consumer price index inflation rate is currently above 2%… We are close to our targets. Not only that, the behavior of employment has been remarkably resilient.

William Dudley

16 August: Market is complacent about the need for gradually snugging up short-term interest rates over the next year or so. We’re edging closer towards the point in time where it’ll be appropriate to raise interest rates further. I think it’s possible. We’re getting closer in the sense that headline inflation is drifting up a little bit… because the earlier declines from energy prices are dropping out of it year over year calculations. We’re looking for growth in the second half of the year that’ll be stronger than the first half — so some acceleration in the growth outlook.

Jerome Powell

8 August: With inflation below target, I think we can be patient… (Hard to raise rates) in a world where everyone else is cutting and demand is weak around the world. I wouldn’t be pounding the table saying we really need to raise rates.

Jackson Hole: My view is, and has been, we should be on a program of gradual rate increases — we can afford to be patient… When we see progress toward 2% inflation and a tightening labor market and growth strong enough to support (a rate hike), we should take the opportunity to do so.

Daniel Tarullo

6 July: Inflation is not at our stated target, not near our stated target, and hasn’t been so in quite some time. This is not an economy that is running hot. For some time now I thought it was the better course to wait to see more convincing evidence that inflation is moving toward and would remain around the 2% target… To this point, I have not seen that type of evidence.

Lael Brainard

3 June (Pre-Brexit): There would appear to be an advantage to waiting until developments provide greater confidence.

James Bullard

Jackson Hole: If we got to a meeting and we felt things were looking stronger, that might be a good time (to hike rates) … We had a couple of good jobs reports here. But year over year, the GDP growth rate is very low, below trend really.

Esther George

Voted for rate hike in July; no reasons to think she will change course for now

Loretta Mester

Jackson Hole: I see a gradual upward pace in interest rates as being appropriate. Now, that doesn’t mean we’re behind the curve now. But I do think that it makes sense to be starting to move interest rates up on that gradual path. I think the economy is on a good track. I think the employment numbers show that; I think the inflation’s numbers are coming up slowly; they’re below our target still but they’re moving in the right direction.

Eric Rosengren

6 June: It is my expectation that economic conditions will continue to gradually improve, which in turn would justify further actions to normalize policy, continuing a gradual return to a more normal rate environment. (Inflation has been) edging closer, (Fed’s dual mandate) likely to be achieved relatively soon. Policymakers must weigh the benefits of low interest rates now against the potential costs in the future of possibly spurring financial instability that will ultimately have downstream adverse effects on firms and households. (Commercial real estate prices) have risen quite dramatically. A somewhat faster move to rate normalization may defer somewhat how quickly we achieve the dual mandate goals of full employment and price stability, but could reduce the risk of a larger divergence from the dual mandate in the next downturn… (This) could make a recession worse than it would have been had policymakers normalized interest rates more rapidly.

Best,

P